Wave vs. Xero: Which Accounting Software is the Best

Xero is one of the most popular accounting systems on the market, known for its clean user experience and ease of use. But it’s certainly not the only option for business owners looking for reliable accounting software. Wave is a popular alternative to Xero that has a unique selling point: it’s free.

But how do the two accounting platforms stack up, and are you better off paying for Xero or using Wave for free?

Here’s our in-depth comparison of Xero vs. Wave to give you everything you need to know before making a decision.

Comparing Xero vs. Wave – which is the best accounting software for you?

What’s the difference between Wave and Xero? The main differentiator is that Wave is free and Xero is not. But there are a few other reasons why one accounting software can be a better fit for your business than the other. Read on for our outline of when it’s best to choose Wave or Xero.

When to choose Wave

1. You’re on a tight budget

While Xero has price plans ranging from $9 to $60 per month, Wave accounting software is free.

You might be wondering if it’s really free. The short answer is yes. Their accounting and invoicing software is free and you get unlimited, instant access to all features after signing up with no need for a credit card.

The only things you’ll need to budget for are central payroll functionality and access to expert services. There are also fees for credit card transactions.

2. You’re a freelancer or small business owner

If you want a budget-friendly accounting and invoicing solution, Wave is a great free alternative to Xero.

Wave is designed for businesses with one to nine employees and offers a straightforward but customizable solution that’s ideal for freelancers in marketing, design and business consulting, as well as small agencies.

In June 2020, Wave launched Wave Money as “the future of small business banking”. This will offer customers a business bank account plus debit card and mobile app with built-in bookkeeping. It’s currently in limited release and only available to US-based, single-owner businesses.

3. You’re in the US or Canada

One of Wave’s main limitations is its accessibility for customers outside of North America. This is where Wave’s automatic bank feeds, payroll and add-on services such as accounting advice are available.

For customers outside the US and Canada, there’s a chance you’ll be frustrated at the lack of options for automated accounting in your region. You can head over to their bank feeds list to check if yours is included.

When to choose Xero

1. You’re outside North America

While Wave’s benefits are mainly limited to customers in the US and Canada, Xero thrives outside of it. Xero is a firm favorite in New Zealand, where it was founded, as well as Europe.

That’s not to say Xero isn’t popular with customers in the US – it absolutely is, and gives competitor and market-leader QuickBooks a run for its money. Accountants love Xero and many are specifically trained in supporting their clients with the software, which is not the case with lesser-known Wave.

2. You’re a freelancer or small business with higher revenue or more complex requirements

Like Wave, Xero is a fantastic choice for small businesses and freelancers. It’s especially beneficial if your business has additional needs, such as billing clients in multiple currencies or integrating inventory and point of sale transactions.

Xero is extremely customizable, although this flexibility does come at a higher price than Wave, especially if you need the $60/month plan to access all features.

3. You’re happy to pay for great user experience and features

For some businesses, saving money on a free product isn’t as beneficial as paying for extra value. Xero is known as the “online accounting software for beautiful business” and its user experience and minimalist interface is hard to beat.

If you loved using Xero during your free trial and it frees up more time than other solutions, we’d recommend you go for it – especially if you only need the low or mid-priced plan.

Feature comparison of Xero vs. Wave

Ease of setup and use

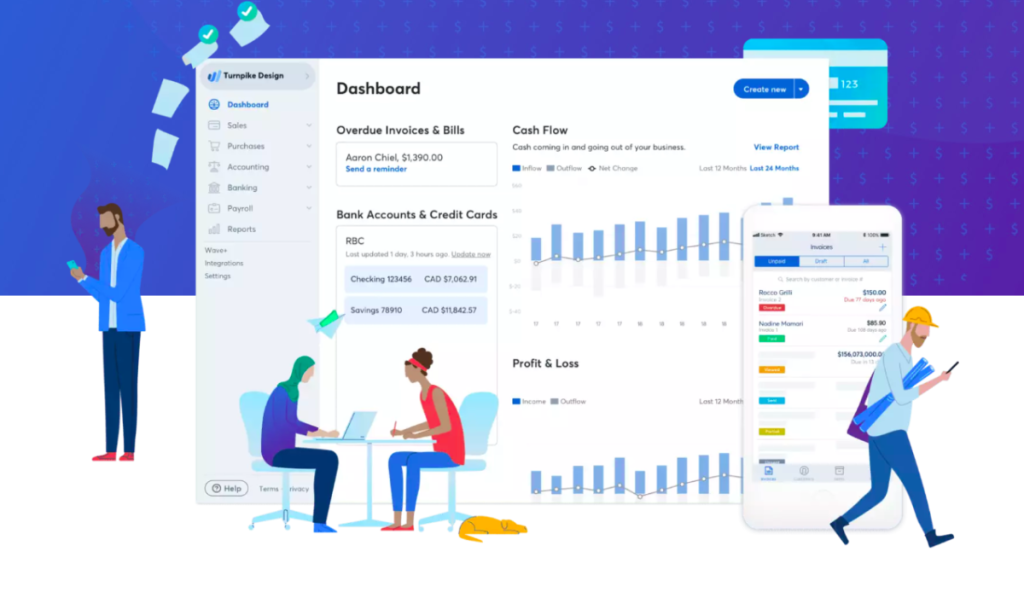

Wave is designed for freelancers and very small businesses, and it’s very straightforward to get set up with. After signing up and inputting your business name and type, you can add your bank accounts and import up to 3 months’ historic transactions if it’s one of 10,000+ connecting banks. You can then add your products, services and customer data.

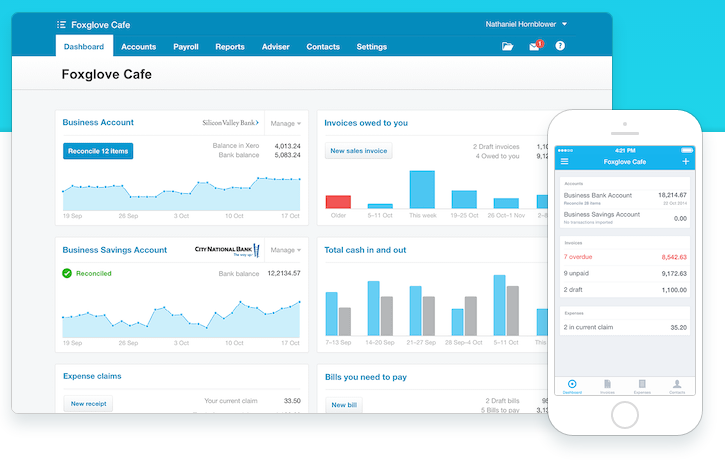

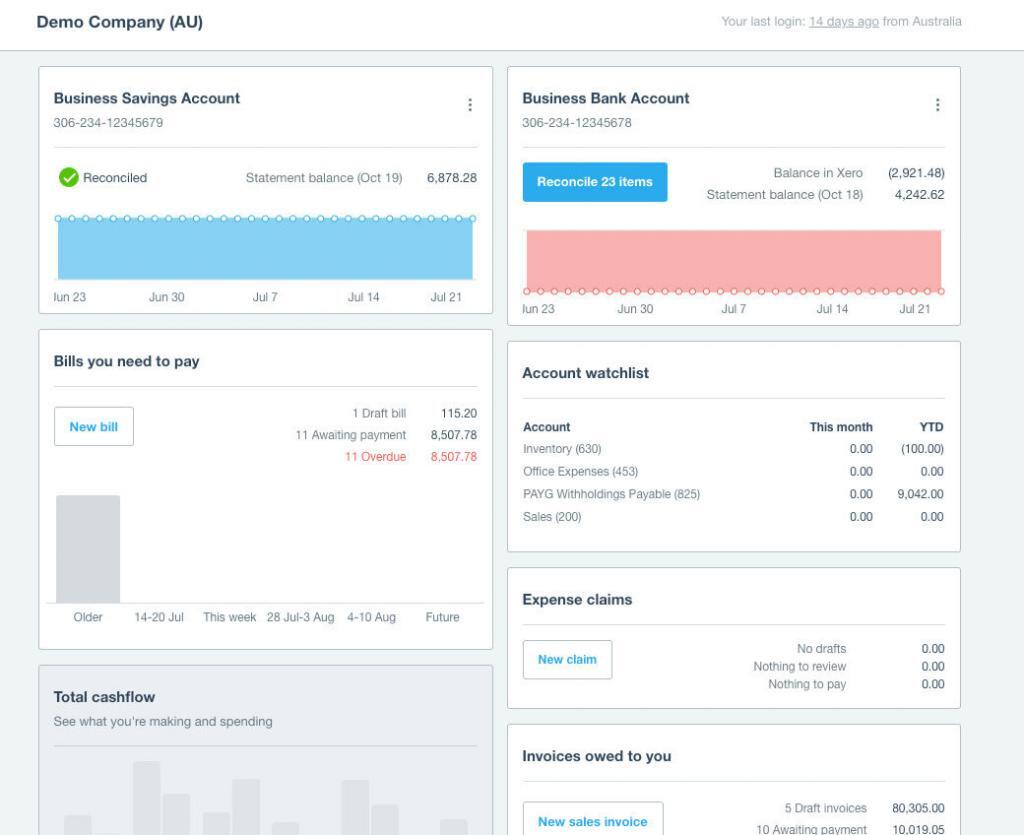

As mentioned earlier, Xero is a joy to use. It’s simple to get started with and it’s incredibly easy to maintain organized accounts. With a feed set up with your business bank accounts (even including TransferWise and PayPal), all you need to do is reconcile expenses to have everything ready for tax time.

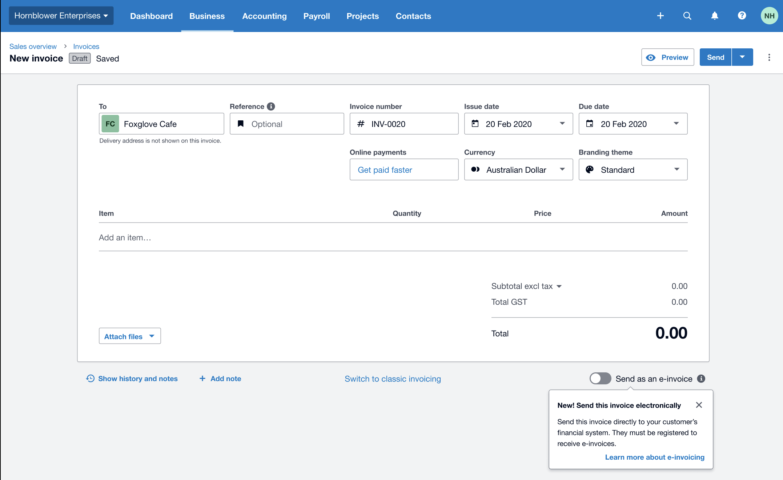

Invoicing

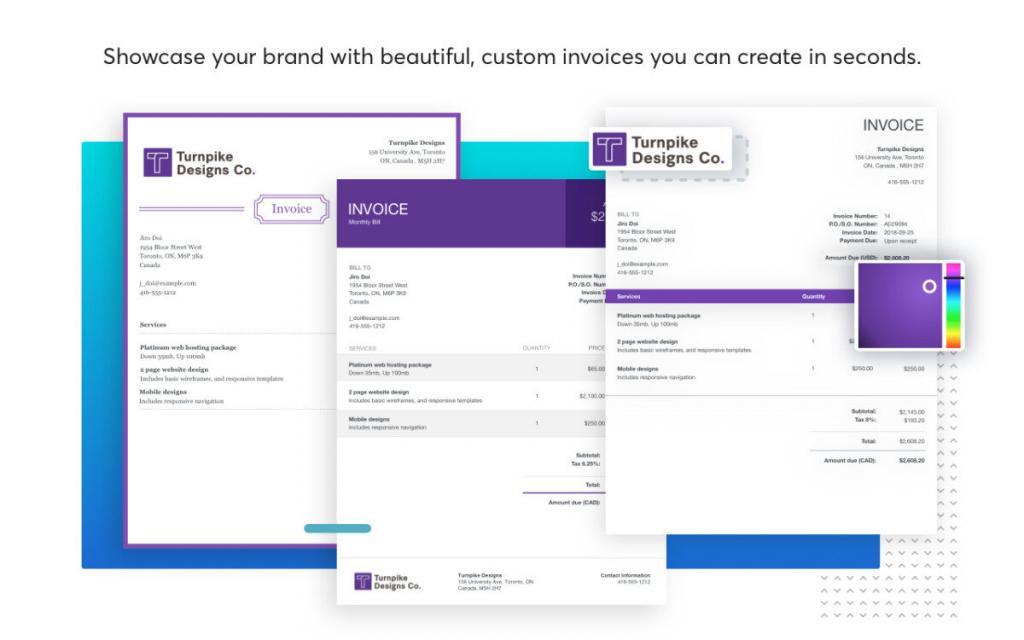

Wave’s free product includes unlimited custom invoicing, which is a major win for freelancers and businesses that primarily need accounting software for this purpose.

Meanwhile, like nearly everything else in Xero, invoices are a piece of cake to set up and send. You can use default invoice templates or create your own if you want something more personalized. Some invoice template edits can be tricky, such as customizing or adding new columns, but for most businesses it’s a breeze to start invoicing clients.

Track expenses

Wave includes unlimited expense tracking, which stands out here – Xero gates their expenses feature behind higher plans and add-ons. Wave’s Receipts app for iOS and Android lets you scan receipts on the go and avoid hoarding paper receipts or wrestling with messy spreadsheets.

Xero also has a user-friendly app to manage invoices and bills, reconcile bank transactions, and monitor spending on the go. It has a high rating of 4.7/5 on both the Apple and Google Play stores.

To track expenses outside of reconciled bank transactions within Xero, you’ll need to choose the $60/month plan with access to the Expenses feature. If you’re outside the US, Xero’s Expenses feature (and Projects) is available as a paid add-on instead.

Reporting

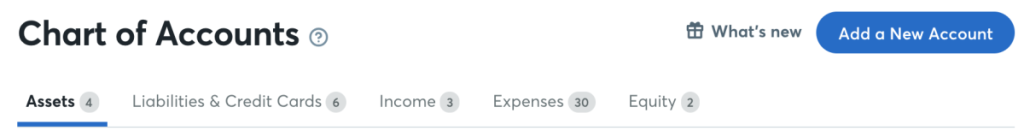

With Wave, the Chart of Accounts section of your dashboard offers a simple overview of Assets, Liabilities, Income, Expenses and Equity accounts to keep your accounting up-to-date all year round:

At a glance, you can also view useful reporting for cash flow statements, profit and loss, balance sheets, sales tax reports and more.

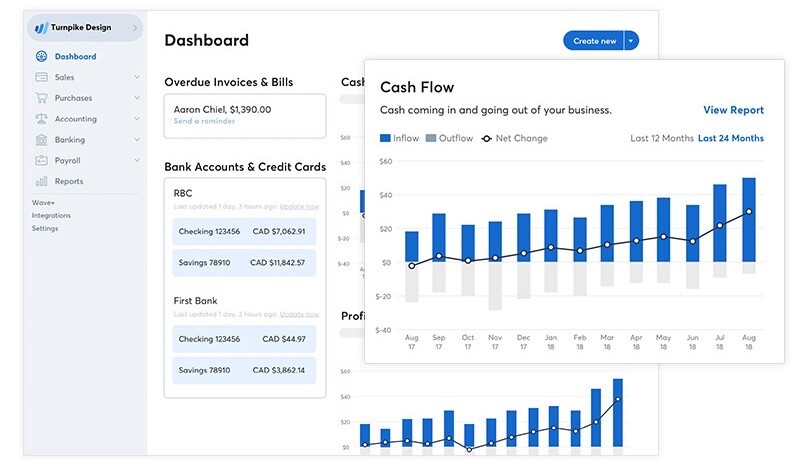

Xero’s reporting suite is extremely easy to navigate and draw conclusions from. You can instantly see your key metrics on the main dashboard, while the Business Performance Snapshot offers deeper insights for the time frame of your choice:

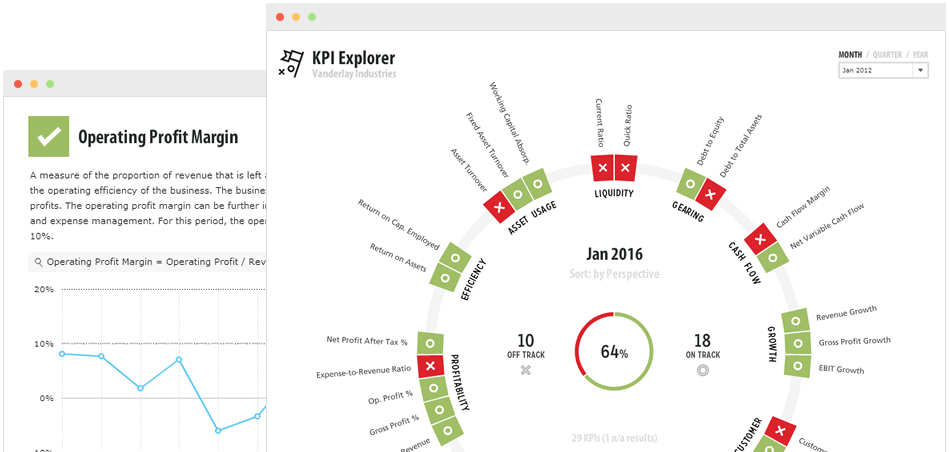

To dig even deeper into your financials, Fathom is a great app with a seamless Xero integration that offers a more in-depth view of your business’s cash flow and profitability:

Integration options

What about connecting Wave and Xero with your other business apps? Here’s how the two accounting platforms compare when it comes to integrations.

Wave offers integrations with PayPal, Shoeboxed and Etsy. You can also now integrate your Shopify orders and payouts with Wave, which is a great bonus for small ecommerce stores.

Xero has a fantastic range of integrations in their App Marketplace. These include apps for inventory and point of sale such as DEAR Inventory and Vend, document signing apps like Proposify, and reporting tools such as Syft and Fathom.

Wave vs. Xero pricing

Wave’s Invoicing, Accounting, Receipts and Payments products are all free to use, but there are a few features of Wave that you need to pay for. These include:

Transactions: With Wave, you pay 2.9% + $0.30 per transaction per credit card transaction for non-European issued cards, and 1.4% + 20p per transaction for European issued cards.

Payroll: If you want to pay your staff with Wave, their payroll service for companies in the US and Canada includes a $20-35/month base fee, plus $6 per active employee and independent contractor paid.

Wave Advisors: If you’re in North America, you can get even more benefits from Wave by paying for a Wave Advisor. Their accounting coaching is available from $79/month, while bookkeeping and a tax service for US businesses start at $129 per month.

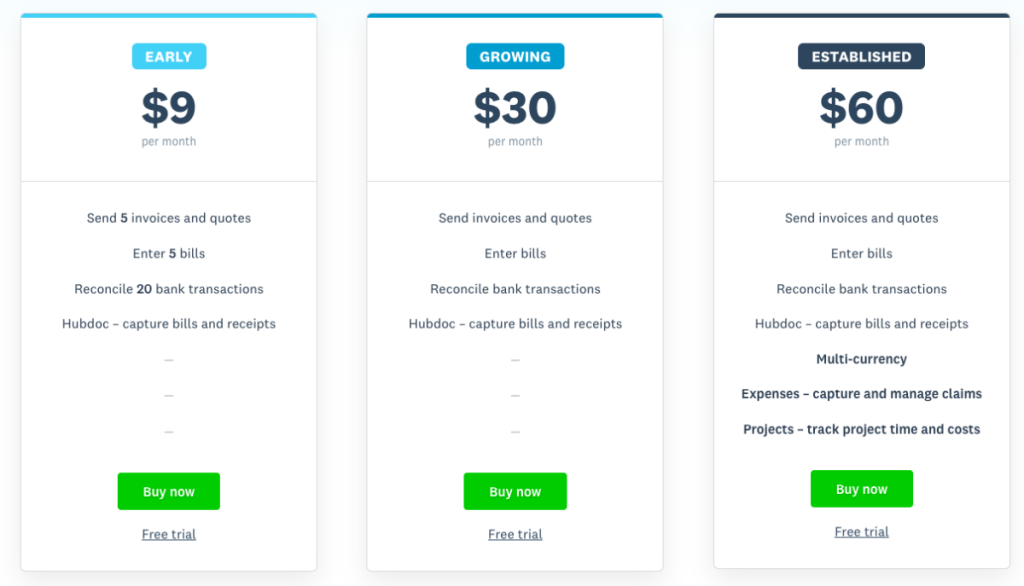

If you choose Xero, you can select one of three paid plans: Early, Growing and Established.

Most businesses will choose the Growing $30/month plan for access to unlimited invoices, bills, and reconciled bank transactions. However, some freelancers and very small businesses will be able to get away with the limits of the Early $9 plan and keep to a smaller budget.

Summary: when to choose Wave vs. Xero

If you’re a very small business or freelancer in North America, Wave might be the ideal accounting software to organize your business and simplify tax time. However, if you have higher revenue, more complex requirements or plan to scale, Xero is likely to be a better choice. Xero‘s user experience and beautifully-designed interface are also hard to beat.

To help you make up your mind whether to choose Wave or Xero, here’s our quick comparison:

| When to choose Wave | When to choose Xero |

|---|---|

| You’re on a tight budget | You’re happy to pay for great user experience and features |

| You’re a freelancer or very small business owner | You’re a freelancer or small business with higher revenue or more complex requirements |

| You’re in the US or Canada | You’re outside North America |