How to Detect and Prevent Authorized Push Payment Fraud

Everyone on the internet is at some risk of a cyber threat. However, at certain points, some individuals are more vulnerable than others. When talking about authorized push payment fraud, this could actually refer to the emotional well-being of the victims.

The authorized push payment fraud, or APP for short, is going to lead to more than $6.8 billion in losses by the end of 2027. This shows just how important it is to recognize and prevent it.

We’ll explore the definition of APP fraud and how to recognize it in a timely manner. Furthermore, the prevention methods are different for businesses and individuals, and we’ll cover both.

Overview of the APP fraud

Like many other online scams, authorized push payment fraud revolves around social engineering. The victims are manipulated into sending money to a certain account, and since they willingly made the transaction, they’ll have a hard time getting a refund.

In the UK, for example, the victims weren’t fully reimbursed for years, which made this particularly dangerous. However, some voluntary organizations helped victims of APP fraud independently of the government or financial institutions.

This type of fraud is similar to phishing, as scammers impersonate legitimate entities or individuals for financial gain. The sophistication of this kind of scam can be quite high, as fraudsters can spend a significant amount of time researching the victim and obtaining their trust.

They can target them at vulnerable times, either emotionally or financially, or during periods when they’re making large investments. The criminals’ requests often have a sense of urgency, ensuring that the victim acts impulsively.

Common APP Fraud examples

The basis of the APP fraud is the same for the majority of cases. The scammers look to manipulate you into sending them funds. However, we can make a few instances in which individuals should pay additional attention.

Impersonation scams

A common type of authorised push payment fraud, impersonation, involves the fraudster pretending to be a bank employee, government official, or even your friend. They contact you often with good intentions, such as protecting your funds or helping you with your account.

The golden rule on the internet is that you should never provide your personal information, especially financial information, to unknown individuals. Legitimate employees of any institution should not ask you directly for your credentials.

Invoice fraud

Fraudsters can fabricate invoices in order to obtain payments. In the case of targeting individuals, they might explore your background and find out whether you’ve been working on something lately.

If you’re preparing to move out, they might send you an invoice that has the details of a moving company. Once you make the transaction, the scammer will receive the money. It’s crucial that you never pay invoices that you are unsure about.

Romance scams

In some situations, fraudsters are ready to go the extra mile and manipulate you for months until they get your trust. APP scams, in terms of romance, are similar to catfishing, but they also involve financial fraud.

These scammers can fabricate emergencies, business troubles, or medical expenses in order to emotionally manipulate the victim into sending them money. There are variations on the romance scam since fraudsters can also impersonate other people and family members for financial gain.

Real estate

People are most vulnerable when making large decisions and investments, such as real estate. Fraudsters can recognize that your house is being renovated and target you with invoices in order to trick you into paying them instead of real contractors.

Similarly, they can combine other types of fraud and malware, such as spoofing, to intercept emails between the victim and a bank or a real estate agency. They then input the fake info in the documents and send them.

This example is probably the most problematic, as purchasing real estate or renovating your home can cost hundreds of thousands of dollars.

Intercepting suppliers

While the previous examples were mainly about individuals, intercepting suppliers is associated with business operations. Criminals conduct APP fraud in this example by obtaining information from businesses and suppliers.

At one point, they used their insights to recreate invoices and send them either to suppliers or to the business. A gullible employee who’s a part of the operation can provide the scammer with info that can be further exploited, or they approve the payment.

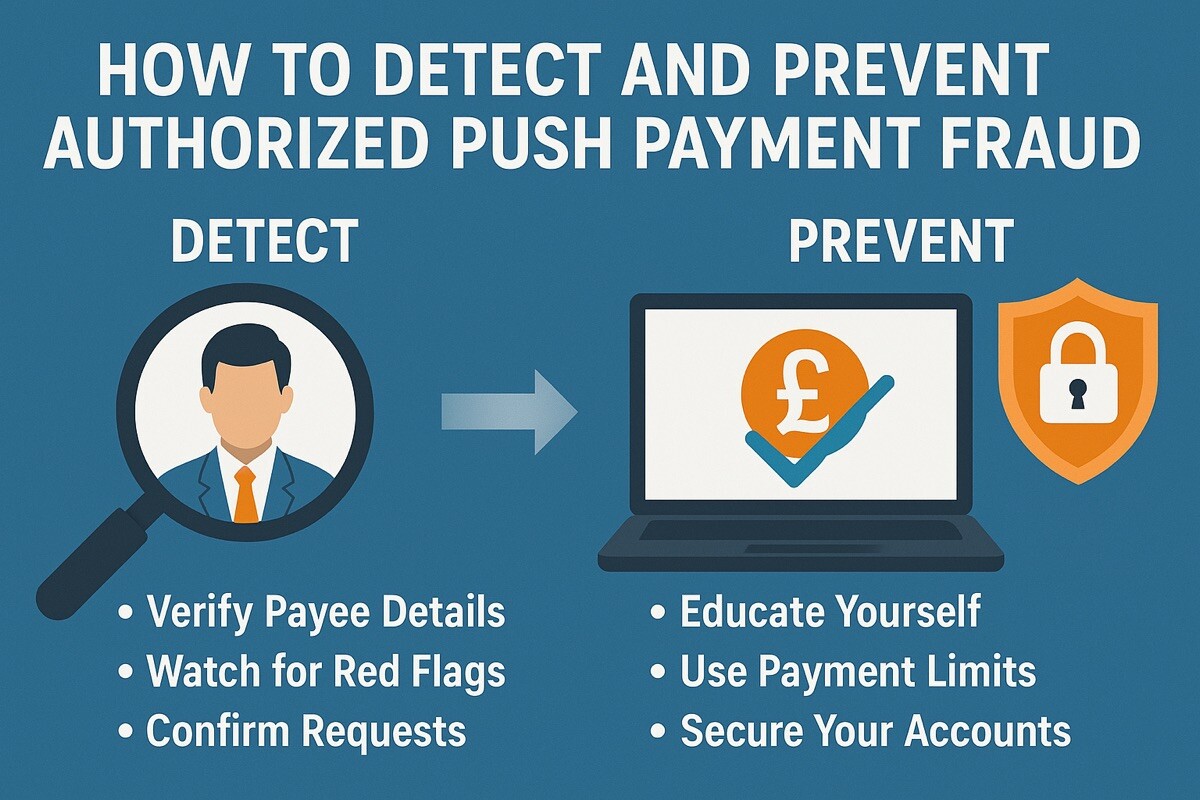

How to detect APP fraud

One of the key traits of APP fraud is that it often appears at random moments. If you’ve been collaborating with a supplier and you have a set date for invoices, you should recognize when they arrive at an unexpected time that this might be a scam.

Of course, sometimes, this can be a mistake, which is why it’s essential to confirm with verified contacts what happened. In terms of impersonations, everyone should know that they should never send any sensitive information on the internet.

If you or your employees get contacted by someone who says they’re from a bank, it’s best to confirm this in person. What’s characteristic of APP fraud is that emails and messages associated with it have a sense of urgency.

For example, “If you don’t send us your financial information so we can update your account, you might lose funds and have your account banned.” This ensures that the individual fears they might lose something unless they take action.

In legitimate situations, suffering such catastrophic outcomes for not taking action is rare, which is why it’s important to double-check this. Like in other similar attacks, such as phishing, the accounts and contacts that participate have inconsistencies.

Their email might not have a domain of a business they’re pretending to be from. Their messages can also have a lot of grammatical errors, which are often rare in professional and formal communication.

If they claim they’re someone you know, it’s best that you check with verified contacts about that individual. Even if you falsely suspect that something is a fraudulent attempt, it’s better to be safe than sorry.

Prevention tips for businesses and individuals

What’s the use of detecting an APP fraud if you can’t prevent it or help others avoid it? These prevention tips should help you avoid becoming a victim.

Businesses and institutions

Businesses should pay close attention to all cyber threats, not only APP fraud. A vulnerability in one aspect can lead to company-wide operational problems, financial losses, and even legal action.

One way to prevent fraudsters from accessing your employee’s account is by implementing multi-factor authentication. MFA incorporates, besides the username and password, additional authentication measures like biometrics or tokens.

The most important prevention method is to educate your employees and help them understand what they should avoid on the internet. Furthermore, this education should incorporate knowledge of how to recognize criminal attempts.

Once you get the potential human error out of the way, fraud prevention software can be significantly helpful. This type of software recognizes suspicious transactions and activities, and stops them before any serious harm is caused.

To protect your customers, it’s also valuable to periodically notify them about phishing attempts and how to recognize them. If anything bad really happens, an emergency response plan should exist.

In order to prevent any fraudsters from leveraging your platform to conduct scams, you should implement the know-your-customer process, ensuring that individuals with criminal pasts are recognized and monitored.

Individuals

While individuals don’t have the resources like businesses for expensive tools and software, they can minimize the risk of fraud through education. As mentioned, you should always verify all requests and contacts you receive.

Practices like MFA are also helpful, and implementing them on all of your crucial accounts can protect you.

Recognizing fraud on time can save your business in the long run

Like in many other cases, human naivety can lead to problems where software is impenetrable. Anyone who uses the internet extensively to make payments must understand how to recognize the most common types of fraud, such as APP.

You can leverage cybersecurity and fraud-prevention tools to protect yourself or your business, but education and training are just as important. Sometimes the initial costs of setting up cybersecurity tools can be high, yet the price you pay if you get scammed is much higher.

Fraud prevention ensures operations and long-term stability for businesses and protects funds that individuals might depend on significantly.