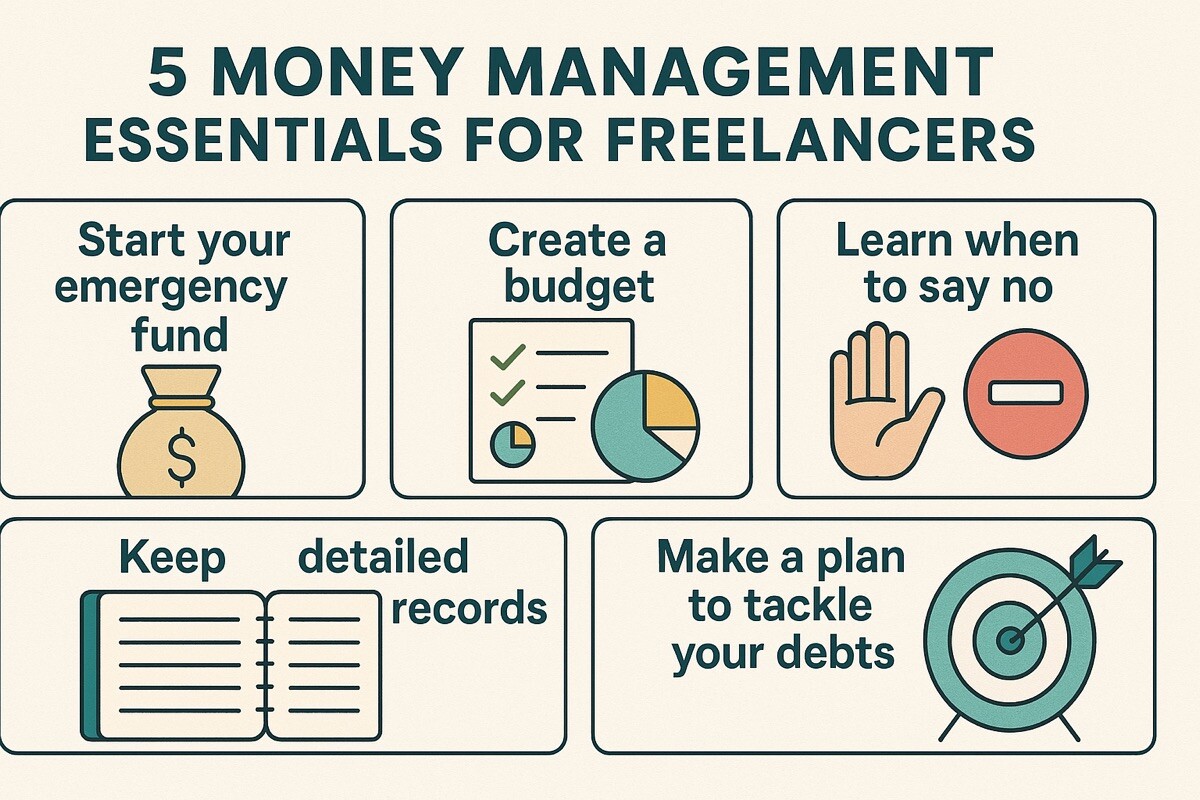

5 Money Management Essentials for Freelancers

Managing your finances is probably the least glamorous part of being a freelancer — but it’s also critical to your success. Here are some essential first steps.

1. Start (or maintain) your emergency fund

Emergency funds are even more important for freelancers than those with 9-to-5 jobs. If you don’t already have one, or think yours could use topping off, start putting aside as much money as you can each month. Aim to save $500 to start — that should get you through small emergencies.

2. Create a budget

Your income varies, but your main expenses won’t, so it’s important to know how much money you need and where it will go. This process might sound stressful, but self-employed personal finance expert Jessica Moorhouse says she finds it easier than when she held a traditional job and had less time to focus on her finances. Now that both she and her husband are self-employed, “because we’re more focused on our budget, we’re happier than when we had more money coming in.”

3. Learn when to say no

You might want to take every opportunity to share your work with the world — and every opportunity to get paid for it — but don’t overwhelm yourself with assignments. It’s better to do your best work on fewer assignments than to take on too many projects and fail to deliver on some. Once you’ve picked your projects thoughtfully, “Have a specific to-do list and a specific project plan,” Moorhouse says.

4. Keep detailed records

This might seem like a no-brainer, but losing track of who paid you how much, for which assignment, on which date can get you into trouble come tax time. Tracking your freelancing income and expenditures on a simple spreadsheet can simplify your quarterly tax payments and the process of filling out your Schedule C form.

5. Make a plan to tackle your debts

Whether it’s sky-high a credit card balance, debt only looms larger when your paycheck isn’t steady. Prioritize your debts and make paying each one down a part of your monthly budget.

Managing your money when you’re self-employed can be overwhelming, but once you get some practice, you can skillfully juggle your finances the same way you juggle your clients.